Security in banks and financial institutions is a very serious matter. Banks handle large amounts of money, sensitive customer information, and important documents. These places are often targeted by criminals, cyber attackers, and even internal threats. Proper protection methods are needed to avoid losses, data breaches, and harm to people. Security systems in these places are stronger and more complex than in normal businesses because the risks are much higher.

Table of Contents

Types of Threats Faced by Banks and Financial Institutions

Different kinds of threats make banks and financial institutions high-risk places. These threats can happen from inside or outside the organization.

- Physical attacks include robbery, theft, and armed assaults.

- Cyber attacks include hacking, phishing, and malware infections.

- Internal threats include dishonest employees or careless behavior.

- Natural disasters like floods, earthquakes, and fires can damage systems or buildings.

- Terrorist attacks aim to cause chaos or destruction.

Physical Security Measures

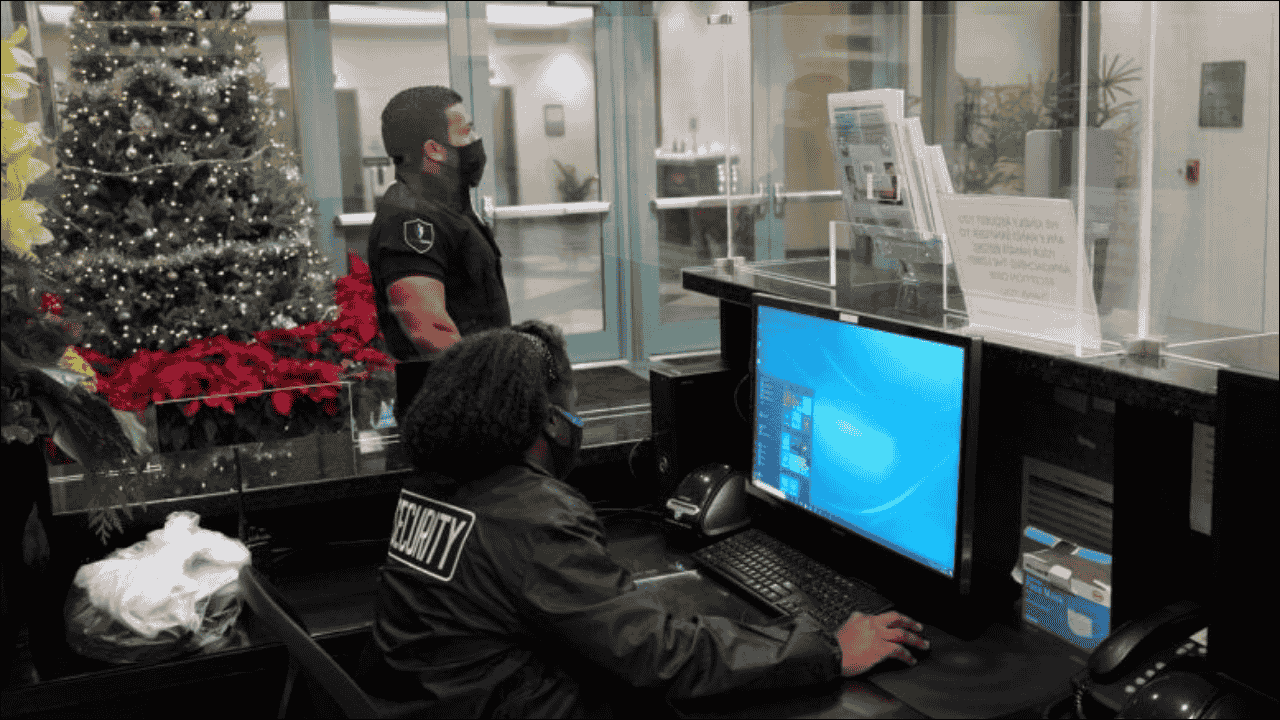

Physical security in banks includes visible protection systems and trained security staff to stop criminal activity.

| Security Element | Details |

|---|---|

| Surveillance Cameras | CCTV systems watch every area of the bank 24/7 and record all activities. |

| Security Guards | Trained personnel guard the premises and react quickly to suspicious actions. |

| Vaults and Safes | Strong metal rooms or boxes store cash, gold, and valuable documents. |

| Alarm Systems | Alarms alert police or private teams in case of a break-in or danger. |

| Access Controls | Entry to secure areas is limited using ID cards, passwords, or biometrics. |

Cybersecurity Strategies

Modern banking involves many online services, so cybersecurity is very important. Proper steps help prevent hackers and protect customer data.

| Cybersecurity Tool | Purpose |

|---|---|

| Firewalls | Stop unauthorized traffic from entering the bank’s network. |

| Antivirus Software | Detect and remove harmful files or software. |

| Encryption | Convert data into unreadable form to keep it safe during transmission. |

| Two-Factor Authentication | Adds an extra step to logging in, such as a code on a mobile phone. |

| Regular Updates | Keep systems and applications protected by fixing security holes. |

Staff Training and Insider Threat Prevention

Employees must know how to handle threats, protect data, and avoid careless behavior that may help attackers.

- Security awareness programs teach employees to recognize scams and suspicious behavior.

- Background checks during hiring reduce the risk of dishonest workers.

- Role-based access ensures that employees can only reach the data they need for their job.

- Monitoring of staff activity helps find unusual patterns that could show an insider threat.

- Reporting systems let staff report issues safely and quickly.

Importance of Risk Assessment

Regular risk assessments are needed to find weaknesses and prepare for possible problems.

| Risk Assessment Step | Explanation |

|---|---|

| Identify Assets | Find out what needs protection like data, cash, buildings, or IT systems. |

| List Possible Threats | List physical and digital dangers that could affect the bank. |

| Check Weak Points | Examine areas where security is not strong enough. |

| Rate Risk Levels | Understand how likely each threat is and how serious the damage could be. |

| Create a Response Plan | Plan actions to reduce risks and improve response during emergencies. |

Security Technologies Used in Banks

Modern technology helps banks protect assets, customers, and employees.

- Biometric scanners check fingerprints or facial features to control access.

- Smart cameras use AI to detect unusual behavior or movement.

- Intrusion detection systems notify managers when someone breaks into restricted areas.

- Secure ATMs have hidden cameras, card protection features, and tamper alerts.

- Cyber forensics tools help trace and understand digital attacks.

Collaboration with Law Enforcement

Strong partnerships between banks and police or other agencies help stop crimes and improve response.

| Collaboration Area | Details |

|---|---|

| Emergency Response | Quick action from police during break-ins or armed robberies. |

| Data Sharing | Exchange of threat information to help prevent fraud or cyber attacks. |

| Training Programs | Joint training sessions for staff and law enforcement on how to handle threats. |

| Regular Drills | Mock events help staff practice reactions during robberies or cyber incidents. |

Customer Data Protection

Keeping personal and financial data of customers safe is a major part of banking security.

- Data is stored in an encrypted form to stop theft or leaks.

- Secure servers are used for banking websites and apps.

- Customer education teaches people not to share passwords or click on fake links.

- Privacy policies tell customers how their data is used and stored.

- Data loss prevention tools block any attempt to move sensitive data without permission.

Security During Cash Transport

Cash transportation is a high-risk task that needs special planning and trained personnel.

| Transport Security Feature | Details |

|---|---|

| Armored Vehicles | Bullet-proof vans used for carrying money to and from the bank. |

| Armed Escorts | Trained guards travel with the van to prevent theft. |

| Route Planning | Changing routes regularly to avoid planning by criminals. |

| Real-Time GPS Tracking | Helps control centers know the exact location of the vehicle. |

| Communication Tools | Secure radios or apps used for contact between escort teams and bank branches. |

Disaster Recovery Planning

Preparation for natural disasters or sudden outages is part of overall security.

- Backup systems store copies of data in safe locations.

- Disaster drills prepare staff to act fast during floods, fires, or power failures.

- Alternative communication methods ensure managers can stay in touch during network issues.

- Insurance coverage helps recover losses after a serious disaster.

- IT redundancy means using extra servers to keep systems running without pause.

Global Standards and Compliance

Banks must follow international and national security laws and guidelines.

| Standard/Regulation | Purpose |

|---|---|

| PCI-DSS | Sets rules for how card payment data must be handled and stored. |

| ISO/IEC 27001 | Focuses on information security management systems. |

| Basel III | Sets standards for capital risk and bank operations, including risk management. |

| GDPR (for EU clients) | Protects personal data and privacy for individuals in the European Union. |

| RBI Guidelines (India) | The Central Bank of India issues rules on bank safety, cyber laws, and customer care. |

Closing Reflections

Bank and financial institution security requires strong systems, skilled staff, and constant upgrades. Threats continue to grow, so banks must stay one step ahead by using modern tools and training their people. Strong protection not only saves money but also builds trust with customers. A safe bank is the foundation of a strong economy and a confident society.